Some Australian homes are earning more than many top-paid professionals thanks to the insane growth we’ve been seeing for the last 18months of this pandemic.

Median house prices in both Sydney and Canberra are jumping more than $1000 per day, overtaking most top-10 earning occupation salaries.

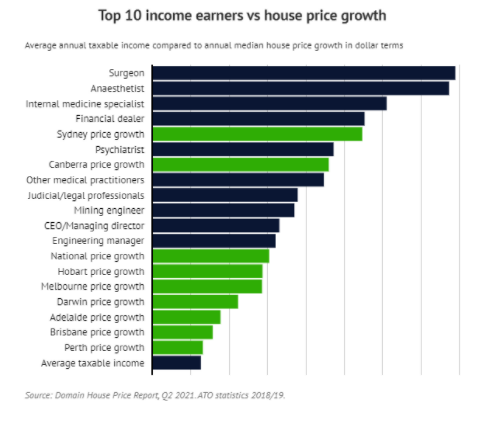

In Sydney the media house price rose almost $107,000 over the quarter, or around $1175 per day to a record media of $1,410,133. That’s more than the nation’s top occupation or surgeon or anesthetist whose average annual taxable income is more than $380,000 over the same period of me.

It also topped incomes of other high earning professionals within the medical and financial sectors, with respective incomes of almost $305,000 and $276,000.

Over the year, these professionals will be ahead financially, with Sydney’s median up to $272,887 over the 12 months to June. However, annual house growth still topped the incomes of other top earners like psychiatrists, judicial and legal professionals and mining engineers.

And the same story has repeated itself in Canberra, where prices rose more than $95,000 over the quarter, or about $1050 per day. House prices are up almost 30% or $229,316 over the year.

So where does this leave the average worker wanting to buy a home? Well in most cases (especially at auctions), they’re going to be priced out before you get a chance to see the home.

And forget having a $100,000+ deposit, if you’re unable to service the loan, it’s a no go so what can you do?

Well savvy investors know that there are properties still available in Sydney from $450,000 and you don’t need to outbid anyone or pay an enormous deposit. And guess what, this is our specialty.

Our goal is to help as many people as possible, create a future of financial freedom for themselves and their loved ones so get in contact on 1300 522 562 or email team@jrprosperity.com.au

When considering an investment property with positive cashflow, it is important to make sure it is suitable to your specific financial goals and objectives. Remember to do you due diligence and is you need advice; JR Prosperity Partners can help you decide if this is the best strategy for you.