It’s no secret that Australia’s property industry is booming!

With record low interest rates, a number of government schemes to get more people into homes, and well, have you read the news lately? Million-dollar homes here, there and everywhere.

It probably seems really daunting to even think about getting into property, or worse, it feels like by the time you have a deposit ready, the market will be even further out of reach for you.

But is it really out of reach?

New research by CoreLogic comparing national dwelling values and average incomes, demonstrated that low-income earners are only able to afford 17.6% of available housing stock in Australia.

And as money expert and editor-at-large for financial comparison site Canstar, Effie Zahos said “Property is basically the number one asset vehicle for most Aussies to actually build their wealth”

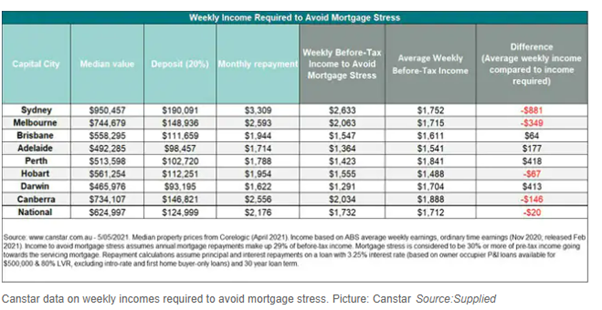

Canstar also calculated how much an Australian needs to earn to afford a modest home in each capital city and came to the conclusion that buying a home and maintaining the mortgage in more than half the capital cities would plunge home buyers into mortgage stress.

Zahos also said “It really does put things in perspective as to how hard people are fighting to actually get into this asset class since it’s experienced such ridiculous growth over the past couple of years. It’s surprised everyone,”

On the flip side, CoreLogic’s study showed that top earners can afford a whopping 85.1 per cent of Australian homes including 93 per cent of all units and 82 per cent of houses.

So, is the Australian dream really over?

From this perspective, it sure seems like it, but to us here at JRPP, this only amplifies how important it is to educate yourself on the property market and to find what investment strategies are out thereto help you build your wealth.

You see, not every home in Australia is out of reach due to its price bracket, and not every bank will ask you for over $100,000K as a deposit.

There are options out there for you to enter the property market today and take advantage of the insane growth we’re experiencing, but it starts with research and having the best people in your corner.

If you’re feeling a little lost or overwhelmed, let us help you.

Our goal is to help as many people as possible, create a future of financial freedom for themselves and their loved ones so get in contact on 1300 522 562 or email: team@jrprosperity.com.au

When considering an investment property with positive cashflow, it is important to make sure it is suitable to your specific financial goals and objectives. Remember to do your due diligence and if you need advice, JR Prosperity Partners can help you decide if this is the best strategy for you. Edit