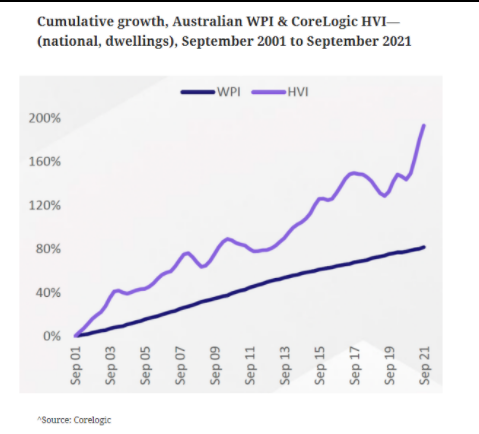

It’s never been cheaper to buy a house, but there has never been such a huge gap between wage growth and property value price growth.

The ABS (Australian Bureau of Statistics) released statistics showing a 2.2% per cent increase in Australian WPI (Wage Price Index).

This is getting back towards pre-pandemic levels 10 year average of 2.4%.

Compared over the last 20 years, where wages have increased 81.7% et Australian home values have increased a whopping 193.1%

So what does this mean for buyers?

First of all, when house prices grow at such a fast rate, faster than incomes, it obviously becomes harder to save the required 10% – 20% deposit. In fact, if we look at the 20% deposit required for the median Australian house price, over the last 20 years it has gone from $25,417 to $137,268.

This is why we’ve seen a surge in the bank of Mum and Dad lately, full use of government initiatives and unfortunately, many more people being priced out of their ideal area.

It really should act as a wake up call for anyone who is still considering whether or not it’s the right time to buy because the market is not going to drop, it’s going to keep doing what it’s always done which is grow.

So if you’re thinking about it, you’ll always be thinking about it.